Property Geek

We provide the actual and accurate information with unbiased user driven reviews to our viewers, to help them see the best and find the best!

View posts

Are you a working Indian citizen? Do you pay rent? Are you given a house rental allowance from your place of work? If yes, this article can help you acquire knowledge on how the rent receipts for paid rent can help you claim the benefits of HRA tax exemption.

A house rent allowance (HRA) is mostly a part of your salary package and to enjoy its benefits, you will be expected to present your rent receipts. After that, you can claim the allowed tax deductions as per the Income Tax (IT) law in India.

To help you, we have curated this article that includes all the necessary information about the house rent allowance, the various components of a rent receipt with a revenue stamp, and the process to generate them online.

Are you a working Indian citizen? Do you pay rent? Are you given a house rental allowance from your place of work? If yes, this article can help you acquire knowledge on how the rent receipts for paid rent can help you claim the benefits of HRA tax exemption.

A house rent allowance (HRA) is mostly a part of your salary package and to enjoy its benefits, you will be expected to present your rent receipts. After that, you can claim the allowed tax deductions as per the Income Tax (IT) law in India.

To help you, we have curated this article that includes all the necessary information about the house rent allowance, the various components of a rent receipt with a revenue stamp, and the process to generate them online.

Under the rental arrangement, a tenant will have to provide any proof of the amount paid to the landlord to claim tax benefits. For this very reason, the tenant needs to show rent receipts that act as documentary proof that you have spent from the salary and to bear the living expenses in rental accommodation.

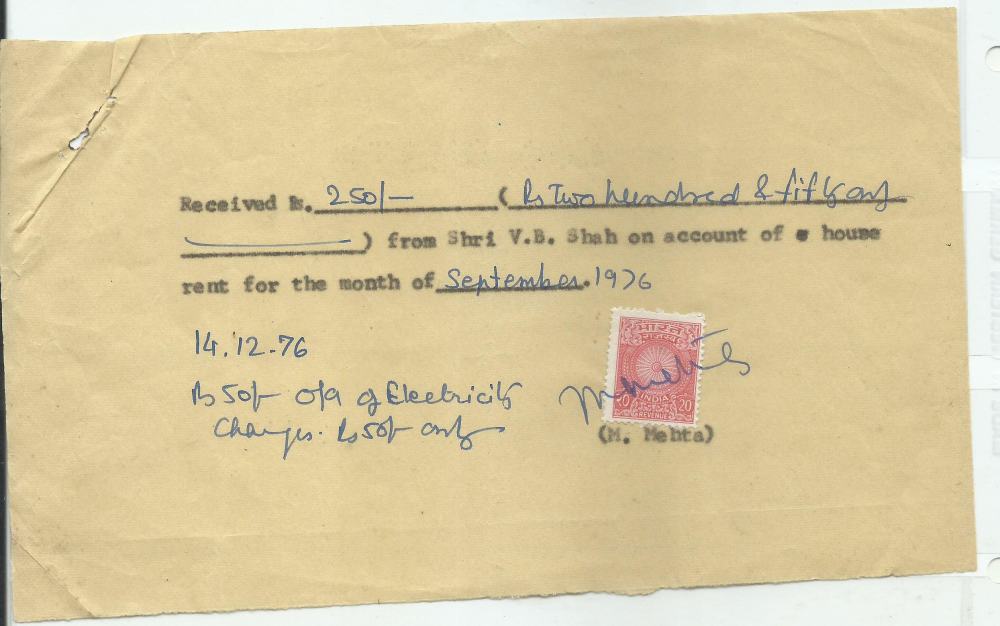

Revenue stamps are the labels issued by the Indian government to collect charges or taxes. These are used in documents related to properties such as rent receipts, tax payment acknowledgment, receipts of cash, etc.

The Indian Stamp Act, 1899 states that a “stamp” is an endorsement, seal, or mark by an authoritative person or agency set up by the government. It indicates the duty chargeable under the Act through impressed or adhesive stamps.

Revenue stamps are affixed on writing, memorandums, notes, etc that involves the following transactions:

A revenue stamp can be bought from your local post offices. It will cost you one rupee for a stamp. These days even online shopping portals or some local stores sell revenue stamps at a higher price. It’s better to buy them from your nearest post office so that you don’t get fake ones.

For claiming HRA exemption, you will have to provide rent receipts with revenue stamps to your employer every financial year as legal proof to calculate the tax liability and claim deductions (but only if HRA is part of your salary package). Remember, you’ll have to submit the rent receipts before the end of the financial year even if you choose to pay the house rent using a credit card or any online money transfer channels.

There is no other way to claim HRA exemption other than by sharing the rent receipts with a revenue stamp with your employer if you pay a monthly rent that is more than ₹3,000. On the other hand, if it’s a lower monthly rent, you need not submit any rent receipts or submit the rent agreement to claim HRA exemption as it isn’t stated by the tax law specifically.

Note – Until the rent agreement isn’t signed and executed between the tenant and landlord, the tenancy of the employee isn’t valid.

House Rent Allowance or HRA is a tax concession that is given to the employees for accommodation, every year. To get HRA from your employer your salary will only include the basic salary and the dearness allowance (DA) component.

As per the Rule 2A of the IT Act 1962, the house rent allowance HRA can be claimed as the minimum HRA received from the employer, 50% of the salary for those living in metros, or actual rent paid minus 10% of the salary.

Sam has a basic salary of Rs 30,000 per month and he pays around Rs 10,000 per month for the rent in Mumbai. Now, the employer offers an HRA of Rs 15,000 per month. Therefore, the benefit of HRA exemption will then be;

HRA = Rs 15,000

Rent paid (less than 10% of the basic salary) = Rs 10,000 – 3,000 = Rs 7,000

The 50% of basic = Rs 15,000

That means, the HRA will be Rs 7,000 and the remaining Rs 8,000 is taxable

Under Section 10 (13A) of the IT Act, the employees who are living in rented accommodations have the right to avail of the HRA exemptions to save tax. As for the self-employed professionals, they are offered HRA tax deduction under Section 80GG of the law.

A rent receipt must include the following information:

Here are the steps to help generate online rent receipts using various platforms for free:

Remember, you must not be an owner or even a co-owner of the property you are paying rent and claiming HRA. However, even if you are staying with your parents but are paying rent, you can claim HRA benefits, and the same is reflected in their salary.

If you are trying to calculate the extent of the HRA exemption, then your salary will only be considered for the period you paid the rent. Here, there will be no HRA tax benefit if the rent paid does not exceed over 10% of the salary for the relevant period.

You don’t need to submit rent receipts for every month you can do so on a quarterly, half-yearly, or annual basis too. Nonetheless, make sure you submit the receipts for the months you plan to claim HRA.

You can pay the rent through any medium of your choice as there are no specifications on rent payments so far. All you need to do is collect the rent receipt from the landlord and submit the rent receipts to the employer.

The tenant needs to affix a revenue stamp on every rent receipt if paid more than Rs 5,000 per receipt, unlike if paid using a cheque.

You would also be asked to provide a copy of the PAN details of your landlords while filing the returns. This is mandatory, only when the annual rent amount exceeds Rs 1 lakh and/or Rs 8,300 monthly. If you fail to do so, you won’t be able to claim HRA in addition to the tax deduction.

If you are sharing a property with another tenant bearing the rental expenses, the HRA deduction will then only be provided to the extent of your share in the rent and not the entire rent amount.

In most cases, employers only ask for soft copies of the rent, however, there are a few who might insist on actual receipts. So, make sure you confirm the same before proceeding with the submission of the rent receipts.

If there is any faulty information on the rent receipt, the amount would be null and void.

You can easily claim for HRA from the IT department at the time of filing the IT returns, in case the employer fails to do so.

Revenue stamps are supposed to be affixed on your rent receipts as a sign of any authoritative entity that officiates your document (whether it is a rent receipt or any other property-related documents). You can claim HRA benefits from your employer for your rent receipts if your rent is more than ₹3000. Calculate your HRA allowance and submit your rent receipt with a revenue stamp to your HR along with other documents to prove your tenancy. Remember to fill in all the details required on the rent receipt before submitting the same.