Property Geek

We provide the actual and accurate information with unbiased user driven reviews to our viewers, to help them see the best and find the best!

View posts

Do you own a home or apartment that is either rented or unoccupied? If that’s the case, you’ll need to know about income from house property and how to calculate income from house property to calculate and pay your taxes.

Calculating income from house property is also significant for tax purposes if the owner of the property wishes to deduct the interest he pays on any home loan he has taken for the same house from the income from the house property. In this article below, we shall discuss in detail what is income from house property and how to calculate income from house property. Let’s get started.

To make tax computations easier, the Income Tax Act has split an individual’s income into different categories. “Income from House Property” is one of these categories. Income from House Property refers to the income collected by the ownership of a home. The actual rent received or receivable by a taxpayer who owns a house property and leases it is taxable.

A house property might be a home, a structure, an office, or a shop. All properties, whether commercial property or home property, are subject to income tax. The property is taxed as income from home property if it is utilized for residential purposes. If the property is utilized for a business or profession, then the property tax paid is classified as the tax on income from business or profession.

The income from house property is added to a person’s gross total income if it meets three basic requirements-

One interesting fact which should be noted by the owner is that the rent from the unoccupied land is counted as additional income from other sources.

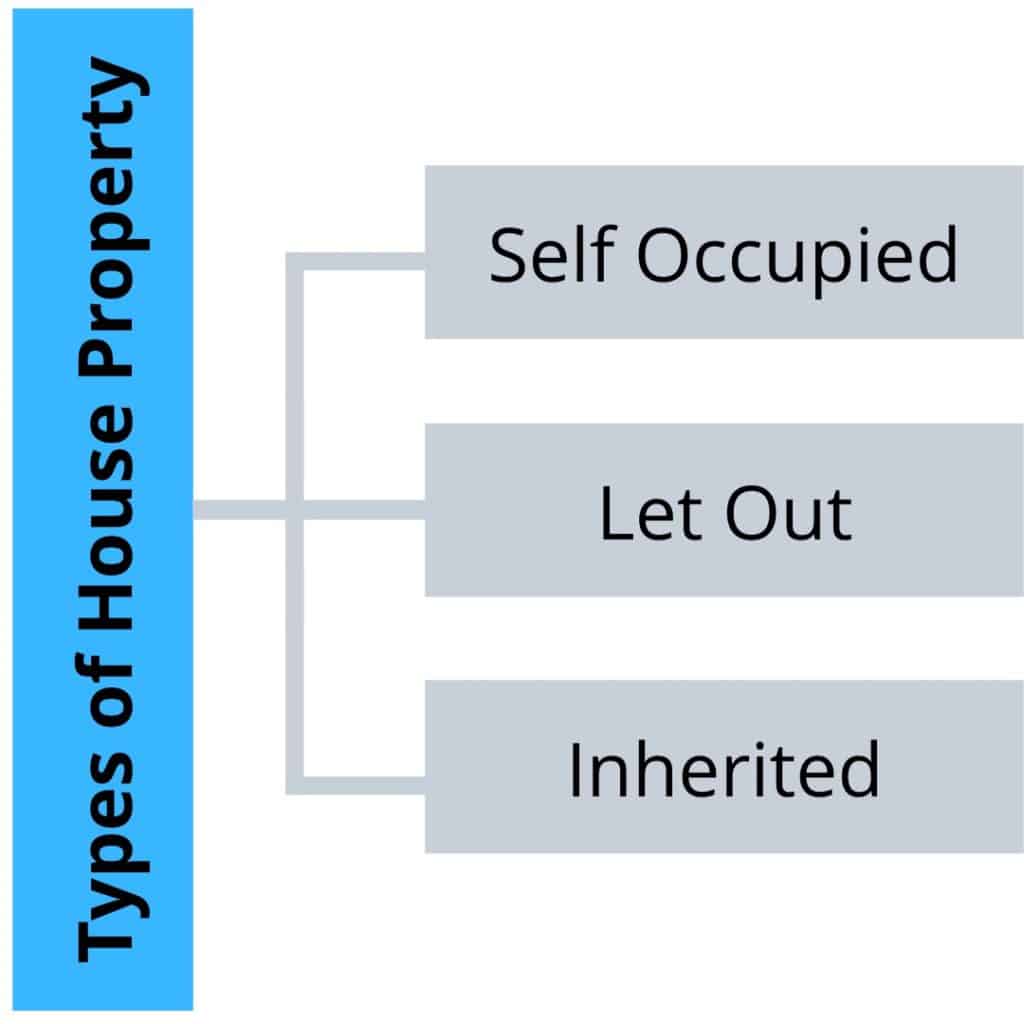

For the process of identifying the taxability of house property income, the income tax divides your earnings into two groups. These are the following:

Self-occupied house property is a property that is self-owned and is used for the purpose of one’s living. This property can be occupied by the owner of the property or any of their family members. For income tax, an unoccupied property is considered a self-occupied property.

If a taxpayer owns more than one house property before the Financial Year 2019-20, only one house property is deemed self-occupied, and the remainder was considered to be let-out property. From the 2019-20 financial year onwards, two house properties are deemed to be self-occupied house properties.

For income tax reasons, any residential property that is rented for the entire year or a portion of the year then it will be considered being a let-out property.

Based on the uses described above, any property that is inherited from parents, grandparents, or others can be classified as either self-occupied house property or let-out house property.

The higher the rent you actually received or the price the property might have fetched on the open market serves as the foundation of taxation for any property you own and rent out. According to income tax lingo, this real rent or market rent is referred to as “annual value”. If you pay any local taxes, these are deducted from the actual or hypothetical rent collected to get the adjusted yearly value.

To the extent that the property is used for business or professional purposes, it will not be liable to tax if all or part of it is utilized for such purposes. The rental income related to such property, which is not held by you, is not taxed within this item but rather under the remaining head “income from other sources.”

Mentioned below is how one can calculate income from house property-

A self-occupied house property has no gross annual value, but a let-out property has a gross annual value equal to the rent received for the same house property.

When property taxes are paid, they can be subtracted from the gross annual value of the property.

The Net Annual Value is calculated by subtracting the property tax from the Gross Annual Value. The formula to calculate net annual value is –

Net Annual Value = Gross Annual Value – Property Tax

Under the Income Tax Act, 30% of the Net Annual Value can be deducted as a rebate from the NAV. Other expenditures, such as repair, rebuilding, or painting, cannot be claimed as a tax deduction above 30% of the income tax act.

The interest paid on a home loan, throughout the financial year is deductible under section 24 of the Income Tax Act.

Your income from house property is the final value that arrives. This is taxable at the slab rate of your income.

If a person owns a self-occupied property that was acquired with a loan, taking a deduction for home loan interest would result in a loss since the Gross Annual Value of the house property will be zero. This loss can be compensated for with income from other sources.

Note: The rental value of a property is its gross annual value when it is let out. The rental value must be more than or equal to the municipality-determined reasonable rent for the property.

If the owner of the property self-occupies the only property he or she possesses, the annual value will be zero. If the owner owns numerous house properties for self-occupation, only one of the house properties is deemed self-occupied, and its annual value can be considered to be zero.

To find the estimation of the gross annual value of let-out house property, the following steps must be followed.

Step 1- Determine the reasonable expected rent of the property (A). The amount for which the property can be reasonably expected to be let out from year to year is known as Reasonable Expected Rent. It is the higher of the property’s Municipal Valuation or Fair Rate, but it cannot exceed the standard rent set by the Rent Control Act. Reasonable Expected Rent = Higher of Municipal Valuation or Fair Rent, subject to maximum Standard Rent

Step 2- Determine the amount of rent that has been received or is due to be received (B).

Step 3- The higher of reasonable expected rent or the amount of rent that has been received or is due to be received, whichever is higher is the Gross Annual Value of let out house property.

Section 24 of the Income Tax Act allows for deductions under the head Income from House Property. These are the following:

Before Budget 2019, if the taxpayer owned multiple residential homes, only one was considered self-occupied house property, and the others were regarded as let-out. After Budget 2019, a taxpayer can own up to two self-occupied residences, and any more than that would be regarded as let out.

Rahul owns a house property with a municipal value of INR 2,50,000 and pays INR 53,000 in municipal taxes. The home loan interest paid by him is INR 2,88,000. Calculate Rahul’s income.

Solution-

| Specifications | Amount(Rs.) |

| A.Gross Annual Value (for self-occupied properties, GAV is considered NIL) | Nil |

| B.Less: Municipal Taxes (For self-occupied, municipal taxes are considered) | Nil |

| Net Annual Value (A-B) | Nil |

| Less: Interest on home loan As per section 24, interest is restricted to INR 2 lakh | Rs 2,00,000 |

| Income from House Property | Rs 2,00,000 |

When an assessee owns more than one property (for the fiscal year 2018-19) or two houses (for the fiscal year 2019-20), the additional properties are regarded to be let-out house property.

Rahul owns a house property that is let out all year. The municipal value is INR 1,45,000, the fair rent is INR 1,36,000, the standard rent is INR 1,24,000, and the actual rent received is INR 1,15,000. The tenant pays INR 5,400 in municipal taxes.

The interest paid on a home loan is INR 3,50,000. He also gets an income of 7,12,000 from his business. Calculate Rahul’s net income from the house property.

| Specifications | Amount |

| A.Gross Annual Value Reasonable Rent: (A) Rs 1,24,000 Higher of Municipal value and Fair Rent Rs 1,45,000 Maximum to Standard rent i.e. Rs 1,24,000

Actual rent received: (B) Rs 1,15,000 GAV is higher of A and B |

Rs 1,24,000 |

| B.Less: Municipal Taxes | nil |

| Net Annual Value (A-B) | Rs 1,24,000 |

| Less : Interest on home loan | Rs 3,50,000 |

| Income from house property | Rs 2,26,000 |

| Less: Set off from Business income | Rs 2,00,000 |

| Net Income From House property | Rs 26,000 |

If the owner of the property or his family lives in the residence, the owner or his family can claim a deduction of up to Rs 2 lakh on their home loan interest. When the house is empty, the same process is applied. The entire home loan interest can be deducted if the property has been rented out.

However, instead of being limited to Rs. 2 lakhs, your interest deduction is only allowed to be Rs. 30,000 if all of the following conditions are met:

Within the overall limit of Section 80C, a deduction for principal repayment is permitted for up to Rs. 1,50,000. The criteria to claim a tax deduction on principal repayment are-

Stamp duty and registration fees, as well as any expenditures directly linked to the transfer, are also permitted as deductions under Section 80C, up to the limit of Rs 1.5 lakh. These costs can be claimed by the owner in the same year that he pays for them.

Homeowners owning only one house property on the date of loan sanction are eligible for a tax advantage of up to Rs 50,000 under Section 80EE, which was recently added to the Income Tax Act.

A new section 80EEA was included in the 2019 budget to prolong the tax advantages of interest deduction for housing loans made for affordable housing from April 1, 2019, to March 31, 2020. The deduction under section 80EE should not be provided to individual taxpayers.

The following are some of the ways through which one can save tax on income from house property

We at Propertygeek, hope that this article was helpful and knowledgeable for you to understand what are the types of house property, how to calculate income from house property, and how the owner of the property can save tax on the income from house property.

The income from a let-out property is taxed based on the owner’s yearly rent income.

The calculation will have to be made separately for each of the properties that are let out.

It is the fair rent that can be charged for house property.

It is the rent that is determined under the Rent Control Act. The owner of the property cannot charge a rent higher than the standard rent fixed under Rent Control Act.