Property Geek

We provide the actual and accurate information with unbiased user driven reviews to our viewers, to help them see the best and find the best!

View posts

A home loan makes owning a dream house possible and easily achievable for families, though it comes with certain nuances one should know in advance about. If you are wondering what is a home loan tenure and whether you can afford a home loan or not, to explain in brief, it entirely depends upon the EMI or Equated Monthly Instalments that have to be paid by you. EMI’s have made payment quite easy as you can pay the principal amount and the interest in such a manner that it does not become a stress to the monthly budget.

However, the rate of interest is the major factor on which EMI depends. Other factors that affect and greatly influence the rate of interest are likely to vary from one lender to another. These factors may be fixed like the repo rate of RBI or the MCLR rate of a bank amongst other variable factors. Let’s explore all factors that affect a home loan tenure and help you realise your dream sooner than later!

MCLR is the Marginal Cost of the Funds and is based on the Lending Rate. The minimum rate of interest that any bank can lend is known as the MCLR interest rate. Other factors on which the interest rate depends include marginal cost of the funds, operating cost, CRR or the Cash Reserve Ratio as well as any form of negative carry on, or tenor premium.

The MCLR has a reset date which is applicable annually, this is when the banks tend to review the borrowers of the already existing home loan and their interest rate. The MCLR may face changes in the course of time, but then it will remain applicable from one reset date to the reset date of the next year. This basically means that the interest rate on your home loan can keep increasing or decreasing, and the changes will majorly depend on the rate of MCLR.

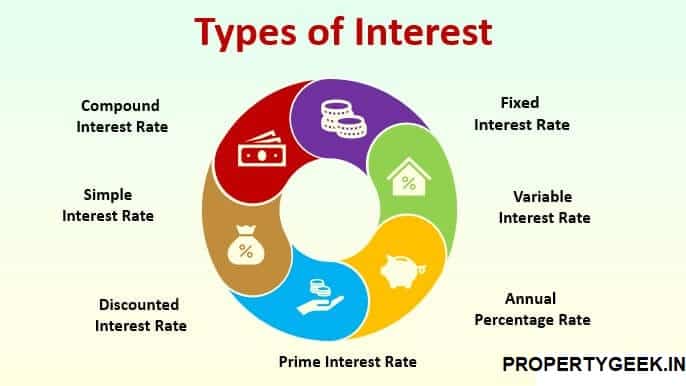

You may choose anything like a floating rate or a fixed interest when applying for a home loan but it is important to take note of what each means.

It must also be noted that if you apply for a loan with a fixed rate of interest, you will initially be charged a fixed interest rate but the rate will then switch to a floating rate of interest.

There is a percentage of any property value that you can finance with the help of the loan, this percentage is known as LTV or Loan to value. If the loan amount is higher the interest rates will also be high because there is more credit risk and vice-versa. You can bring the quantum of the loans down if you put down a large down payment, this will also help in reducing the interest rates too.

This indeed has an important impact on the loan interest rates. Your credit score can be called a statement that records your habits, financial discipline, creditworthiness, and repayment history.

If the credit score is low, it portrays a higher credit risk which may cause the lender to charge higher interest rates because they have to cover the risks incurred too. On the other hand, if the credit score is high, it will portray a low credit risk for an individual and you may get a lower rate of interest from the lender.

Home loans depend a lot upon where you are considering your property to be located and the rates of interest change accordingly.

If you are thinking of a home that is situated in a locality that has great amenities and good connectivity, it is likely to have a resale value that is higher. If you have a home with a neighborhood that is not desired much can be cheaper, and at the same will give a low value of resale.

Similarly, if the property is new it will be considered more valuable and properties that are old will basically have a low resale value. The lender considers homes with a better resale as a property that is lucrative therefore, they are likely to charge a home loan interest rate that is low.

At the same time, if you are thinking of a home with a resale value that is low, interest will be gradually higher.

One of the factors that influence the home loan is the source of income of an individual; if the income is stable it is considered to be low-risk and if the source of income is unstable, it becomes high-risk.

The job profile must be good and income must be stable to get a lower rate of interest, job profiles like government employees, salaried professionals, PSU employees, or people working in a private sector firm typically get a good rate. However, chartered accountants and doctors are included in the category of self-employed jobs, hence are high-risk.

If your home loan tenure is short, it is likely to attract interest rates that are low. Even though EMI’s will be high, home loan interest rates will be less if the tenure is long. An EMI calculator may be helpful for you to find out the interest rates for any tenure.

These are some major factors that are most likely to influence the home loan tenure as well as your home loan eligibility. As we found out, some of the factors can be controlled by you, but some get affected by the country’s economy. So when you decide on the loan, you must keep these factors in mind and it will indeed help you in getting one of the best values of the loan that fits your requirements and budget.

The lenders are the one who decides the maximum home loan tenure as well as the home loan minimum tenure. However different banks may have different policies. While some of these are within your control, others are influenced by the economy.

All in all, while factoring out a home loan option, always keep in mind the home loan tenure as it highly affects the interest rate. The maximum home loan tenure is offered by a lender is 30 years, while the home loan minimum tenure is 5 years.

In order to get a home loan, you can fill in the online application form, after which the documents will be verified, along with a background check. After all these steps, you have to process the payment, and go through the process of loan approval. Applying for home loans is quite easy now as everything is online.

There are various ways to repay your loan, you may quickly repay with higher rates of interest, try a debt consolidation loan, foreclose the personal loan, etc.

An individual is eligible for a home loan if he/she is 18 years old, and minimum income is 25,000 per month, however, this criteria may vary from one bank to another.

There are several factors that affect the interest rates, like the tenure of the loan, the location of the property, as well as the job profile of an individual. There are other factors, but these are some of the most important ones that you must keep in mind.

A down payment is a kind of partial payment that can be availed on a kind of purchase of items or services that are expensive. Down payment can be paid with cash or anything that is equivalent during the time of the final transaction.